This page provides a resource for research studies and reports on UK broadband. All references are provided for further research, and full summaries are given below. The reports include the Connected Nations 2024 (OfCom) and UK Broadband Statistics 2024 (USwitch), which comprehensively analyse the UK’s broadband and mobile connectivity landscape. These studies focus on infrastructure improvements, accessibility, pricing, and customer experiences, offering insights into the progress of technologies like full-fibre broadband, gigabit-capable networks, and 5G coverage.

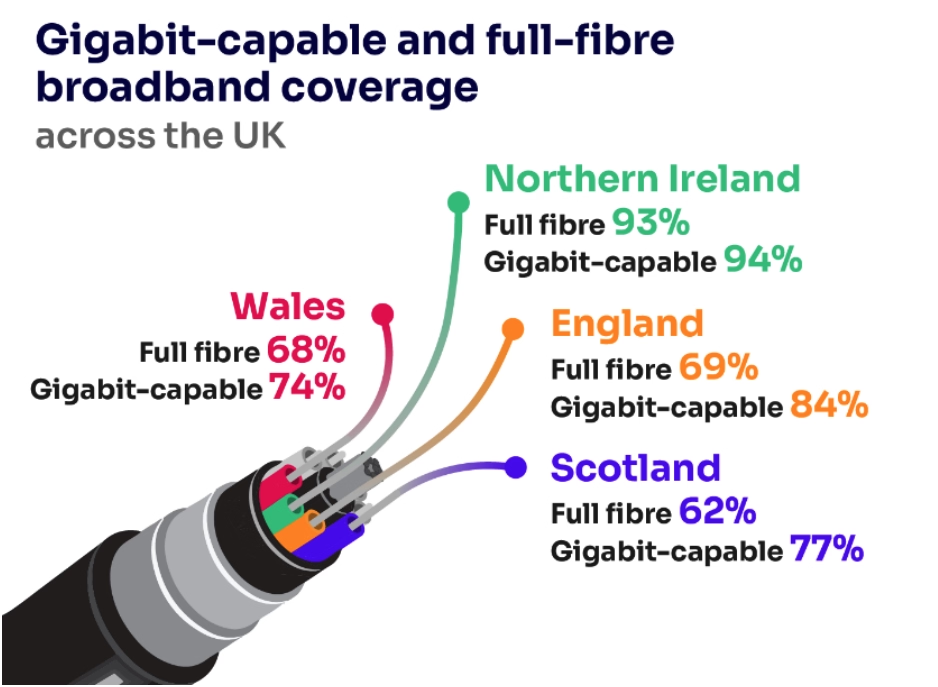

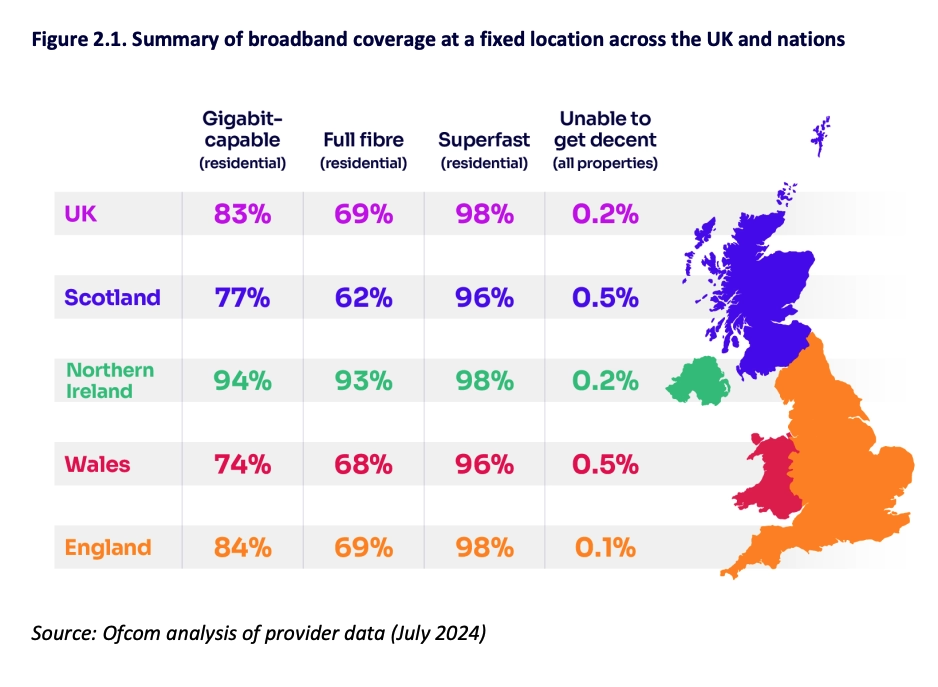

The Connected Nations 2024 report remains a cornerstone for understanding the evolution of the UK’s communications infrastructure. As we progress into 2025, recent government investments, emerging 6G pilot programs, and sustainability initiatives are reshaping the digital landscape. This update reflects additional research findings on fixed broadband, mobile network advancements, and future connectivity trends.

Ofcom’s commitment to ensuring that communications work for everyone continues to drive innovation. The 2024 report, now enhanced with 2025 research, details progress in full-fibre, fixed wireless access (FWA), and 5G mobile networks—while also previewing emerging 6G trials and green connectivity initiatives. An upgraded interactive dashboard now features real-time analytics, allowing for granular exploration of regional performance and future projections.

The digital infrastructure in the UK continues to benefit from strong government and private sector investments. The recent Budget allocated an extra £800 million to Project Gigabit to expedite gigabit broadband rollouts across Great Britain by 2030. Concurrently, sustainability initiatives are being introduced to ensure green connectivity, while SRN and early-stage 6G trials set the stage for next-generation networks.

As connectivity advances, consumers enjoy faster downloads, smoother streaming, and reliable support for multiple devices. Enhanced indoor and outdoor mobile coverage supports remote working, smart home applications, and emerging IoT ecosystems. While significant progress has been achieved, bridging the digital divide remains essential as new technologies—including 6G and sustainable network solutions—continue to evolve.

For interactive data insights and a more detailed regional breakdown, explore the latest statistics on the updated Ofcom Dashboard.

The UK Broadband Statistics 2024 report by Uswitch.com provides valuable insights into the current state of broadband services across the United Kingdom. Whether you’re streaming your favourite shows, working from home, or simply browsing the internet, understanding these statistics can help you make informed decisions about your broadband needs.

The average cost of broadband in the UK has risen slightly to £26.90 per month as of 2023. Among the UK nations, Wales offers the most affordable broadband at an average of £26.87 per month, just below the national average. In contrast, Northern Ireland has the highest average cost at £28.04 per month, which is about 4% more than Wales.

BT remains the largest broadband provider in the UK with approximately 9.3 million customers. Following BT, Sky Broadband serves 6.7 million customers, and Virgin Media has a market share of around 5.7 million. Smaller providers like Glide and KCOM cater to niche markets and specific regions, with Glide holding a market share of 400,000 and KCOM less than 140,000 subscribers.

Broadband costs vary significantly based on speed and connection type:

Among connection types, FTTP (Fibre to the Premises) is the most expensive at £29.86 per month, followed by FTTC (Fibre to the Cabinet) at £26.41. ADSL and Mobile Broadband are cheaper options, averaging £20.33 and £18.70 respectively.

Customer satisfaction varies across providers:

The most common issues reported include:

Social broadband tariffs offer reduced-cost broadband for low-income families. However, awareness remains low:

Despite the benefits, more than half of eligible customers are unaware of these cheaper options, especially among younger people and men.

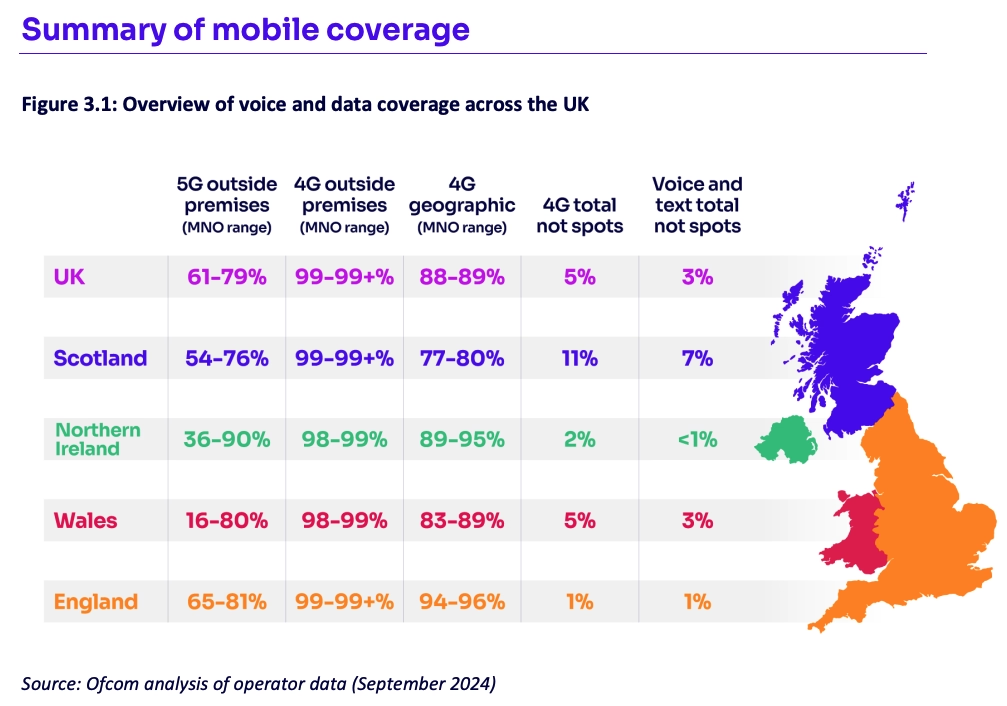

Mobile broadband continues to expand with the rollout of 5G:

Providers like BT/EE lead in 5G coverage, while the Shared Rural Network (SRN) initiative helps improve mobile connectivity in rural areas.

Continuous investment is driving broadband improvements:

As broadband becomes more affordable and widespread, consumer take-up is increasing:

These benefits contribute to a better digital experience for UK households, enhancing productivity, entertainment, and communication capabilities.

Note: Deals on Broadband is a comparison website for broadband providers. We don’t own any services and make a small commission by linking customers to provider websites. Broadband deals and packages change frequently. While we aim to keep all information on this site up-to-date, we strongly recommend checking the current information for each service provider for accurate and recent pricing, information, and terms and conditions.

© 2025 Deals on Broadband